PLAN DESIGN CHANGES

ACA Affordability Standard

- Confirm that at least one of the health plans offered to full-time employees satisfies the ACA’s affordability standard (9.02%). Because an employer generally will not know an employee’s household income, the IRS has provided three optional safe harbors that ALEs may use to determine affordability based on information that is available to them: the Form W-2 safe harbor, the rate-of-pay safe harbor and the federal poverty line safe harbor.

Out-of-Pocket Maximum Limits

- Review the out-of-pocket maximum limits for the health plan to ensure they comply with the ACA’s limits for the 2025 plan year; and

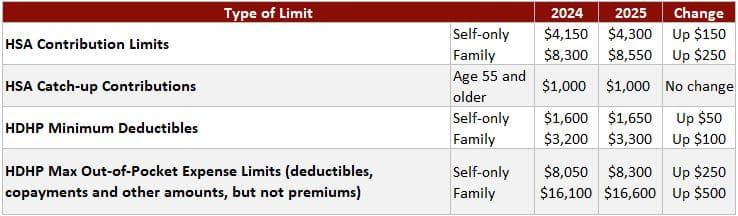

- Keep in mind that the out-of-pocket maximum limits for HDHPs compatible with HSAs must be lower than the ACA’s limits. For the 2025 plan year, the out-of-pocket maximum limits for HDHPs are $8,300 for self-only coverage and $16,600 for family coverage.

Preventive Care Benefits

- Evidence-based items or services with an A or B rating in recommendations of the U.S. Preventive Services Task Force;

- Immunizations recommended by the Advisory Committee on Immunization Practices for routine use in children, adolescents and adults;

- Evidence-informed preventive care and screenings in guidelines supported by the Health Resources and Services Administration (HRSA) for infants, children and adolescents; and

- Other evidence-informed preventive care and screenings in HRSA-supported guidelines for women.

- Confirm the health plan covers the latest recommended preventive care services without imposing any cost sharing when the care is provided by in-network providers.

Health FSA Contributions

- Monitor future developments for the release of the health FSA limit for 2025;

- Once the IRS releases the health FSA limit, confirm that employees will not be allowed to make pre-tax contributions in excess of the limit for the 2025 plan year; and

- Communicate the health FSA limit to employees as part of the open enrollment process.

HDHP and HSA Limits

- Check whether HDHP cost-sharing limits need to be adjusted for the 2025 limits; and

- Communicate HSA contribution limits for 2025 to employees as part of the enrollment process.

HDHPs: Expiration of Design Options

- For plan years ending after Dec. 31, 2024, an HDHP is no longer permitted to provide benefits for COVID-19 testing and treatment without a deductible (or with a deductible below the minimum deductible for an HDHP); and

- For plan years beginning on or after Jan. 1, 2025, an HDHP is no longer permitted to provide benefits for telehealth or other remote care services before plan deductibles have been met.

- Confirm that HDHPs will not pay benefits for COVID-19 testing and treatment before the annual minimum deductible has been met;

- Confirm that HDHPs will not pay benefits for telehealth or other remote care services (except for preventive care benefits) before the annual minimum deductible has been met; and

- Notify plan participants of any changes for the 2025 plan year regarding COVID-19 testing and treatment and telehealth services through an updated SPD or SMM.

EBHRA Limit

- Decide how much will be contributed to the EBHRA for eligible employees for the 2025 plan year, up to a maximum of $2,150; and

- Communicate the EHBRA’s annual benefit amount to employees as part of the open enrollment process.

Mental Health Parity – Required Comparative Analysis for NQTLs

- Reach out to health plan issuers (or third-party administrators) to confirm that comparative analyses of NQTLs will be updated, if necessary, for the plan year beginning in 2025.

Prescription Drug Benefits – Creditable Coverage Determination

- Confirm whether their health plans’ prescription drug coverage for 2025 is creditable or noncreditable as soon as possible to prepare to send the appropriate Medicare Part D disclosure notices; and

- Continue to utilize the simplified determination method for determining whether prescription drug coverage is creditable for 2025, if applicable.

Open Enrollment Notices

Summary of Benefits and Coverage

Medicare Part D Notices

Annual CHIP Notices

Initial COBRA Notices

SPDs

Notices of Patient Protections

HIPAA Privacy Notices

WHCRA Notices

SARs

Wellness Program Notices

- HIPAA Wellness Program Notice—HIPAA imposes a notice requirement on health-contingent wellness programs offered under group health plans. Health-contingent wellness plans require individuals to satisfy standards related to health factors (e.g., not smoking) to obtain rewards. The notice must disclose the availability of a reasonable alternative standard to qualify for the reward (and, if applicable, the possibility of waiver of the otherwise applicable standard) in all plan materials describing the terms of a health-contingent wellness program. The DOL’s compliance assistance guide includes a model notice that can be used to satisfy this requirement.

- Americans with Disabilities Act (ADA) Wellness Program Notice—Employers with 15 or more employees are subject to the ADA. Wellness programs that include health-related questions or medical exams must comply with the ADA’s requirements, including an employee notice requirement. Employers must give participating employees a notice that tells them what information will be collected as part of the wellness program, with whom it will be shared and for what purpose, as well as includes the limits on disclosure and the way information will be kept confidential. The U.S. Equal Employment Opportunity Commission has provided a sample notice to help employers comply with this ADA requirement.

ICHRA Notices

Next Steps

At Van Wyk, we create custom employee benefits communications that aid in employee education and emphasize program value. We also conduct virtual and/or onsite open enrollment meetings according to your preference with recordings available for new hires and those employees who were unable to attend the live session.

To learn more about the Employee Benefits services we offer to businesses like yours, visit our Employee Benefits webpage. If you’re looking for employee benefits or open enrollment assistance, contact us via the form below today. And be sure to like us on Facebook and follow us on LinkedIn for more insurance news and tips!

This article is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.