If your business is only focusing on insurance premiums as your way of quantifying risk, you may be missing costs that you have more control over.

BusinessSolutions

Full Circle

When business owners accurately measure risk, they tend to possess the motivation to invest in a more effective risk management effort, which can provide a significant rate of return and the following benefits:

– Increased productivity, profitability and efficiency.

– Reduced costs across the entire business, not just reduced insurance premiums.

– A better idea of any inconsistencies in the organization’s risk management approach.

Risk Solutions And Services

- Property Insurance

- Commercial Vehicle/Fleet

- Workers’ Compensation

- Casualty Insurance

- Marine Insurance

- Errors & Omissions

- Excess & Surplus Lines Market Access

- Excess Umbrella

- Directors & Officers

- Product Recall

- Cyber Liability

- Pollution Liability

- Surety Bonds

- Global Placements

- Group/Employee Insurance Programs

- Liability Consulting

- Loss Control

- Multi-State Programs

- Program Audits & Consultation

- Claims Advocacy & Management

- Retention Programs

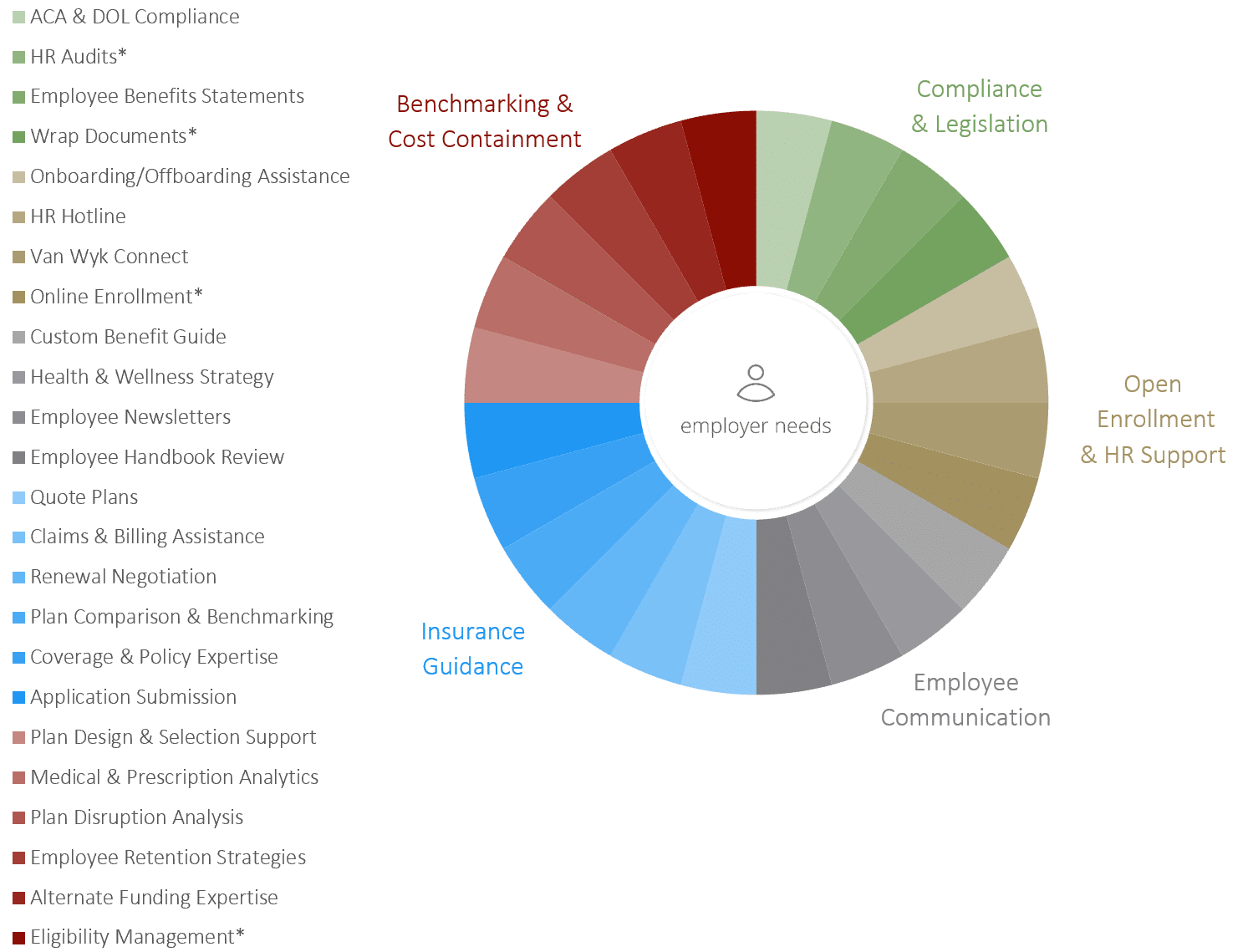

Break away from the mold of the traditional broker. The average broker meets your basic needs when it comes to claims, plans, and renewal negotiation. What about new exposures like cyber attacks? New legislation? Injuries on the jobs? Preparing for OSHA?

From compliance to communication, let us provide risk solutions for you and your business. We understand the challenges today’s employers face, and we know you’re asked to take on more than ever before. Let Van Wyk exceed your expectations.